One of the most popular investment options for many people looking to diversify is in the real estate market. Unless they have years of experience, however, it can seem an intimidating process to learn for the first time. However, once you’ve looked at your finance options, it becomes clear that there are many ways to wisely invest in land and construction, well as both commercial and residential investment property.

What Investment Financing Covers

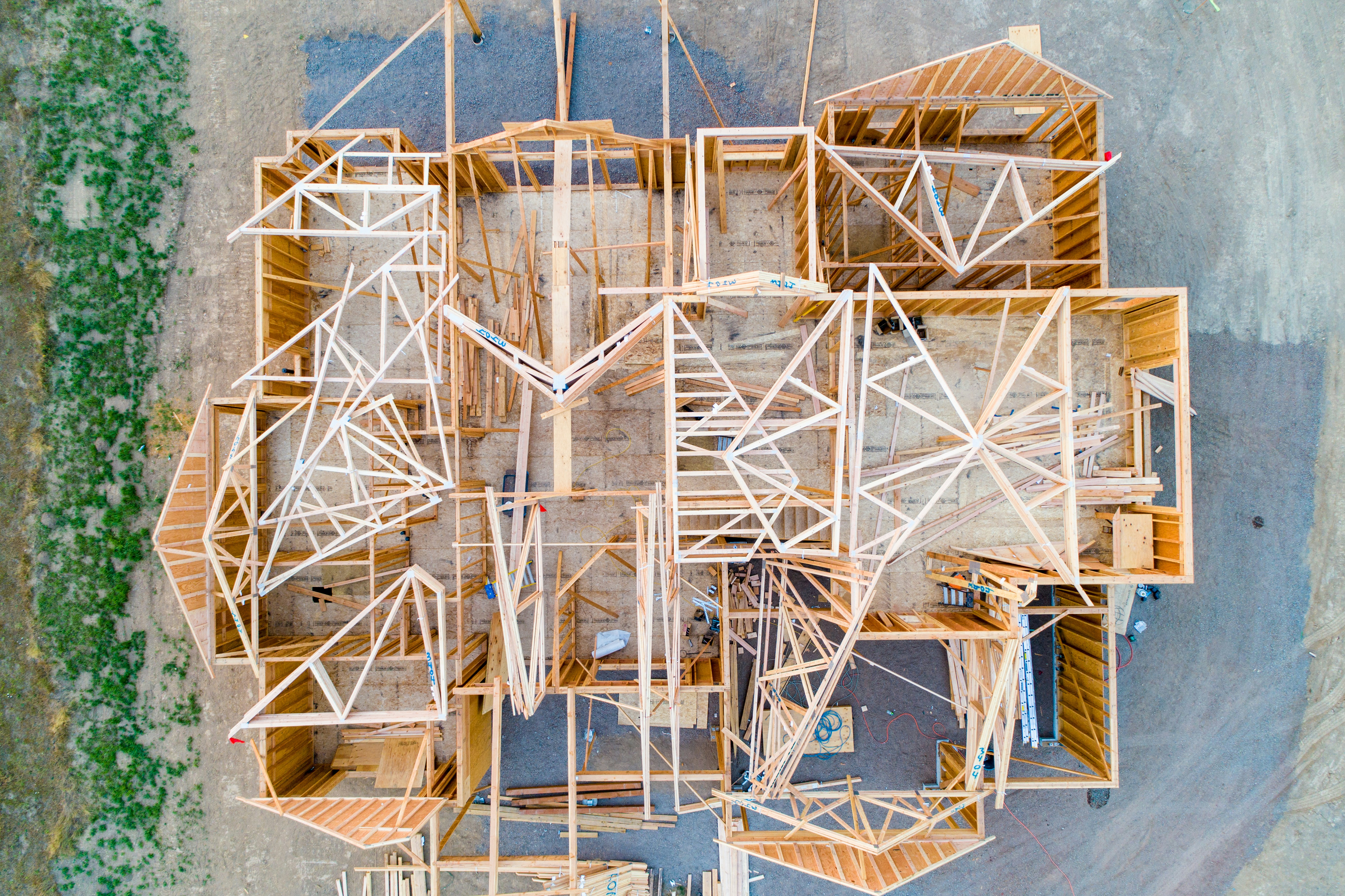

Truth be told, every element of a real estate project will require a hefty budget, and your investment can go a long way. Whether for the commercial property itself or for a house-flipping project, as a lender, you can put your funds towards the acquisition of land, an existing structure, or a new home that’s built from the ground up. Not only will the hiring of a general contractor and full team of experienced crew members be needed, but you’ll also need such crucial items as the water filtration system, faucets, dishwasher installation and other appliances, and the whole house system for air conditioning and heat, as well as expert plumbing for the water supply. All materials must be accounted for, and there are also numerous permits to be filled out for future inspections.

It may appear daunting, but if taken one step at a time, you and your fellow investors can see the full project through from beginning to end, and find a healthy return. Luckily, new construction financing can also include options like soft term bridge loans, hard money loans, or approaching a private money lender to aid in formulating your initial investment budget.

Conventional Loans

Popular not only to those new to real estate investing, but also to many experienced investors, is to apply for a conventional loan for the property or other aspects to a construction project. Also known as mortgage, the borrower provides a down payment, while the bank or financial institution provides the rest of the needed funds in exchange for a lien on the property, which is secured by the mortgage. One thing to remember, however, is that conventional loans are rarely used to flip houses for profit, as most mortgages are underwritten for a term of years or possibly decades. And while there is a limit as to how many mortgages you can attain, and this is contingent on your credit score, the interest rates tend to be lower than other forms of loans.

Hard Money Loans

With a hard money loan, there are many aspects that can attract investors. The biggest incentive in opting for hard money is that it’s exactly as described: a full lump sum of cash needed to make your invested right away. If you’re interested in applying for this popular form of short term lending, just keep in mind that terms and fees vary from state-to-state, and hard money loans in Oregon may be different in structure and terms than ones in New York, California, or elsewhere. Always review the details.

A hard-money lender will use the property itself to secure the loan, making this option ideal for investors interested in renovated old structures and “flipping” them for profit as a newly remodeled home. And while there are many hard money lenders looking to help out with construction projects, the interest rates for such a short term loan structure can sometimes be high.

Private Money Loans

Another popular option for new investors is working with a private money lender in order to secure their budget. As this is form a of loan that comes from an individual rather than an accredited, secured financial institution, the terms can be largely dictated by the lender. An attorney should be utilized to oversee the transaction, including the collateral, interest rates, and other aspects of the legalities between the lender and borrower. A major attraction to seeking private money loans is that your credit score or investment history won’t necessarily play a part in approving your loan. However, in exchange for such flexibility within private lending is the potential for higher interest rates than a conventional alternative.